INTRODUCTION:

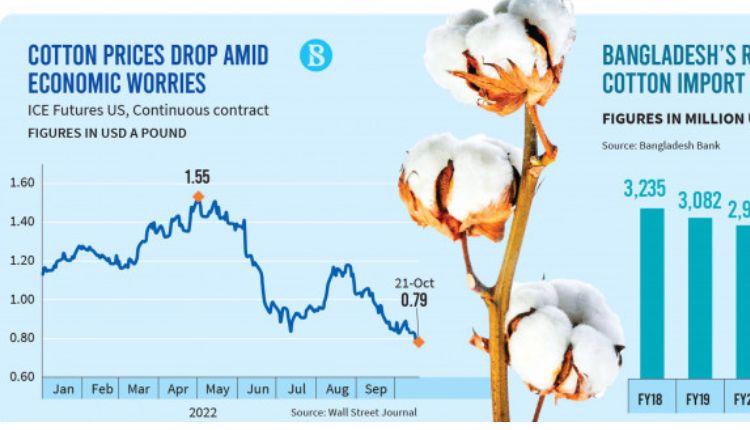

In today’s dynamic world, the prices of such essential materials as gold, silver, or even cotton are very important in making financial decisions by farmers and traders. Furthermore, investors are greatly involved. The prevailing cotton rate today is related to the on-going fluctuations taking place across global markets, including demand-supply imbalances and trade policies. Knowing such situations is quite important to anyone dealing with agriculture, textile industries, and so forth.

INCREASING RECENT COTTON RATES:

Cotton is considered white gold in India because it is one of the largest producers of cotton. This crop provides a livelihood for nearly every farmer. The cotton rate today is influenced by many factors including weather patterns, pest control systems, and market trends. So, farmers need to ensure the quantity of the crop so that it matches the demands of people.

The impact of recent cotton prices extends beyond the agricultural sector. The textile industry consumes a great quantity of cotton, and price changes very often affect production. Higher prices of cotton raise production costs, which raise costs to the consumer. On the other hand, if prices are lower, the textile industries become more competitive which also boosts the exports and contributes to the economy.

IMPACT OF INCREASING GOLD PRICES:

There are other commodities to consider too, such as gold that has cultural and financial significance. The demand for gold in India can be explained by facts such as wedding seasons, festivals, and investment motives.

Gold rates today are very responsive to the general economic situation, changes in currencies, and other important news. During times when there are uncertainties in the economy, investors often refer to gold as a safe option to drive the prices up. But when the global economy is stable, gold prices may decline and investors get higher returns in equities.

In India, gold rates get most of their pricing from the value of the Indian Rupee against the US Dollar. As gold is traded globally in US Dollars, any decline in the Rupee would make gold expensive in the Indian market.

RELATABILITY:

The interplay between cotton and gold prices highlights the dynamics of the Indian economy. While cotton prices can directly affect the agricultural and textile sectors, gold prices have a widespread impact including on consumers. So, you should stay informed about the prices of these materials as it will help you make informed decisions.

CONCLUSION:

The fluctuating rates of cotton and gold underscore the importance of staying updated on the latest market trends. Whether it is a farmer, trader, or an investor, understanding these price movements can help you evaluate the complexities in the Indian economy.

For recent cotton those who want to stay updated with the trends, platforms like 5paisa offer valuable tools and a user-friendly interface. It enables you to track the most recent prices and make informed decisions. With the right information, you can manage the upcoming risks or opportunities that come while you invest in commodities like cotton and gold. If you also wish to become an investor, then you should start following platforms like 5paisa which will help you with the navigation of investment options.