In modern cryptocurrency trading, efficient capital management is just as important as timing the market. As institutions increasingly enter the digital asset space, they require mechanisms that maximize capital use across multiple positions without increasing risk exposure.

This is where portfolio crypto margin access becomes handy. This is a professional tool that enables traders and institutions to use portfolio-based margining for enhanced trading flexibility.

Portfolio crypto margin access allows participants to manage collateral collectively across multiple positions instead of isolating margin requirements for each trade. This means that profits from one asset can offset potential losses in another, significantly improving capital efficiency.

For institutional investors and high-volume traders, this type of system represents a powerful upgrade to traditional margin models.

How Portfolio Crypto Margin Access Works

Understanding how portfolio crypto margin access works requires a look at risk assessment on a portfolio level. Unlike standard margin systems that treat each position separately, portfolio margining evaluates the total risk exposure of all positions combined.

When a trader holds multiple positions across correlated assets — for example, Bitcoin, Ethereum, and Solana — the margin system calculates the net risk instead of the gross exposure. This often results in lower margin requirements because the system recognizes offsetting positions.

The objective of crypto portfolio margin is to allow institutions to use their capital more efficiently without sacrificing safety. Margin calls and liquidation risks are reduced through smarter balance monitoring and real-time portfolio evaluations.

In essence, crypto portfolio margin access is a tool that ensures liquidity, optimizes collateral, and supports diversified trading strategies, making it essential for professional participants who operate across multiple markets simultaneously.

Institutional Crypto Trading Solutions on WhiteBIT

For professional investors, exchanges that offer dedicated infrastructure for portfolio margining are becoming increasingly attractive. Among them, institutional crypto trading solutions on WhiteBIT stand out for their robust security, scalability, and integration with advanced trading systems.

WhiteBIT’s portfolio margin framework enables institutional clients to manage risk and capital allocation across various digital assets in real time. This system benefits hedge funds, liquidity providers, and algorithmic traders who manage complex multi-asset portfolios.

Key features of the WhiteBIT crypto portfolio margin access program include:

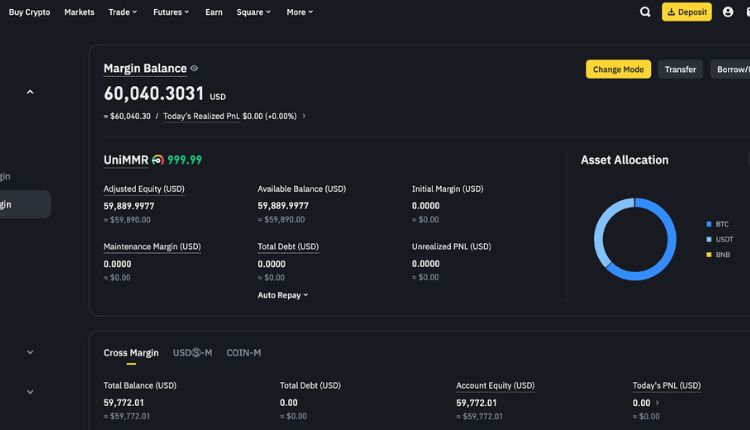

- Cross-asset margining. Use a unified collateral pool to manage multiple positions across spot, futures, and margin markets.

- Reduced capital lock-up. Free up unused margin by offsetting profitable and losing positions dynamically.

- Advanced analytics. Access real-time portfolio performance, PnL tracking, and margin ratio monitoring.

- Institutional-grade security. Custody protection through cold storage and compliance with regulatory standards.

- Scalable architecture. Seamless integration with APIs and trading terminals for algorithmic strategies.

By combining these capabilities, WhiteBIT helps institutions maintain competitive execution while managing risk effectively across multiple trading products.

Benefits of Portfolio Crypto Margin Access

The benefits of portfolio crypto margin access extend far beyond capital efficiency. For professional traders and institutions, these systems provide strategic advantages that reshape how digital assets are managed.

- Optimized Capital Usage. Collateral requirements are calculated on the net exposure of the entire portfolio, reducing idle funds.

- Dynamic Risk Management. The system continuously evaluates volatility and correlation between assets to update margin levels.

- Improved Liquidity. Freed capital can be reinvested or used to open new positions.

- Lower Liquidation Risk. Since the margin is calculated at a portfolio level, the likelihood of premature liquidation decreases.

- Better Execution Strategy. Traders can pursue complex hedging and arbitrage strategies across assets and markets.

For institutions, these benefits translate to lower operational costs and higher returns on deployed capital.

What Is Crypto Portfolio Margin Access in Practice?

In practice, what is crypto portfolio margin access depends on how exchanges implement it. Some use a simplified netting model, while others apply sophisticated risk algorithms based on asset correlation matrices and stress-testing scenarios.

At its core, the system gives traders greater flexibility to hedge, diversify, and manage exposure dynamically. By evaluating risk holistically, it rewards balanced portfolios rather than punishing diversification — a crucial advantage for funds managing multiple strategies.

This feature also enhances transparency, as traders can view their overall exposure, leverage, and liquidation thresholds at any moment. As a result, institutional participation becomes more stable, and liquidity conditions improve across the ecosystem.

The Future of Institutional Margin Trading

As the crypto market continues to evolve, portfolio-based margining will likely become the industry standard for institutional trading. Exchanges offering sophisticated infrastructure for risk management and liquidity access will play a leading role in defining the next generation of digital finance.

Solutions such as institutional crypto trading solutions on WhiteBIT demonstrate how exchanges can merge technology, security, and analytics to meet institutional needs. For professional traders and funds, this creates a bridge between traditional portfolio management and blockchain-based assets.

Portfolio margin systems represent a major step forward for the cryptocurrency industry, aligning digital trading practices with traditional finance standards. The ability to assess and manage risk across an entire portfolio rather than individual trades provides unmatched efficiency and flexibility.

By integrating portfolio crypto margin access within their institutional frameworks, exchanges like WhiteBIT are setting new benchmarks for professional crypto trading. For institutions seeking advanced tools for risk optimization, liquidity, and capital efficiency, portfolio-based margining isn’t just an upgrade — it’s the new foundation of responsible, scalable, and profitable crypto trading.